How COVID-19 has Affected the United States Economy

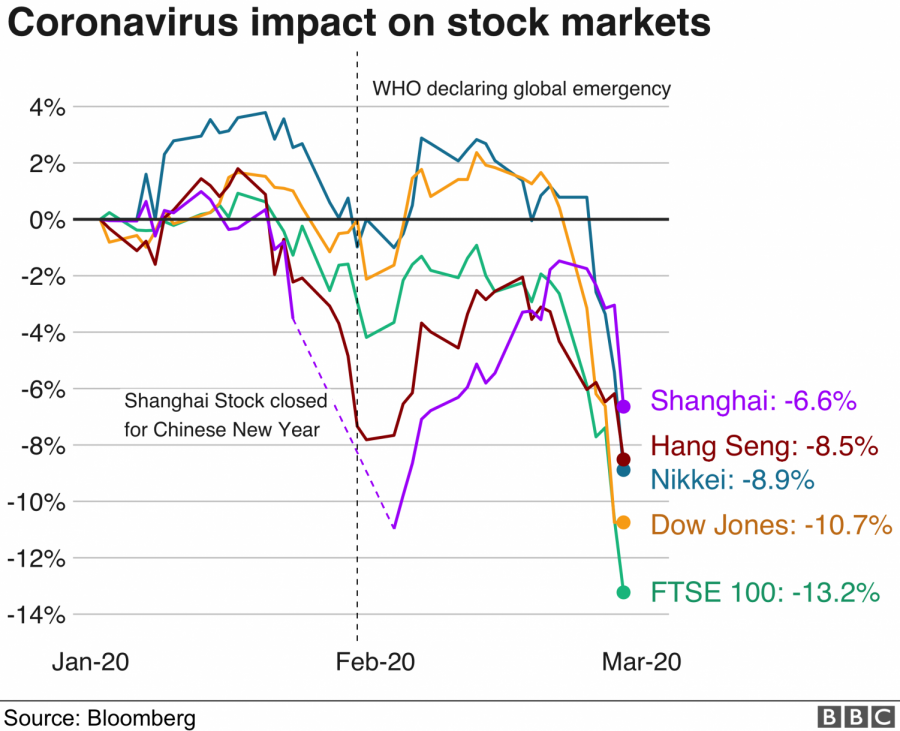

Due to the coronavirus, the stock markets have decreased greatly in the past couple of months. (Photo By BBC News}

COVID-19 has made its way over to the United States, and it is not just the wellbeing of our people that is being affected but the economy and the stock market have been affected as well. The stock market has played a huge role in our economy since the very beginning of the United States of America. Many people rely on the stock market for retirement money and their other important financial needs. In the 1920’s the stock market crashed, leaving many families without a home, a job, and money.

The panic that this virus has resulted in turmoil in the global stock market. Many people are unemployed due to the stay-at-home order and cannot provide for their families. The demand for oil has decreased due to families being stuck inside. Travel has also been restricted, and people are told to stay at home. As a result, the economy and stock market have been negatively affected and heading towards a recession.

Many people are preparing for a recession in the United States’ economy in 2020. A recession is a decline in economic activity in the economy after a period of growth, which can be caused by imbalances in the economy building up. The 2001 recession was caused by an asset bubble in technology stocks. Due to the COVID-19 pandemic, a recession in the United States economy is possible.

The stock market, during a recession, usually declines quickly and sharply before leveling out at the bottom. After a few months, it will reassemble and the economy will start to buzz again.

Hi, I’m Imogene Ragan and this year is my second year on the Newspaper Staff and my sophomore year at North! I love writing, reading, the ocean, and...